Emotional response is risky during market correction periods

Short-term volatility is an almost-certain fact of life in the capital markets, one investors and advisors must handle with a clear and rational approach. The past 12 years have seen an average of 62 days per year where the S&P 500 moved more than 1%, with a drop of more than 20% about every five years since 19421. While the past never indicates future performance, corrections have been spooking investors for nearly as long as markets have been operating.

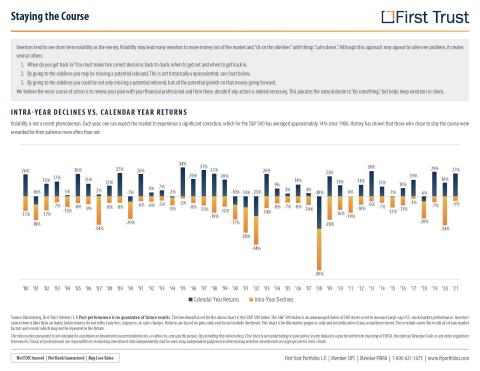

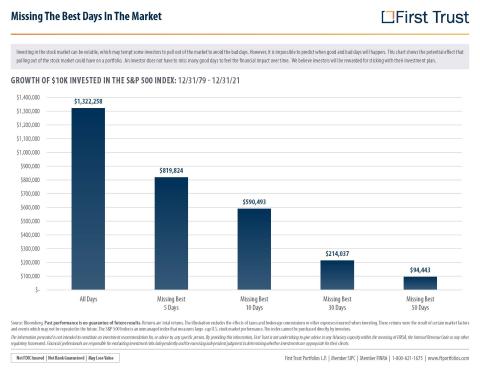

The instinct to move money out of a quickly-dropping market and "sit on the sidelines" during a correction can present a host of challenges, not the least of which is deciding when it is safe to get back in. The S&P 500 has annually corrected an average of 14% since 1980 (see chart A), and history has proven that those who stayed in the market during the correction period were rewarded2. The penalty for pulling out of the market, and potentially missing the market's best days, can have a substantial negative effect. In one example, $10,000 invested on 12/31/1979 and kept in the market until 12/31/2021 would have been worth 38% less by missing just the five best days in the market over that time period (see chart B).

While market corrections will happen, the greater risk to investors is not the inevitable downturn, but the emotional response. Consult with your Cranbrook Wealth investment professional to ensure your portfolio is designed to meet your financial goals even amid challenging market conditions.

Sources:

1. Bloomberg, 4/29/1942 - 12/31/2021

2. First Trust Advisors L.P.