Capital gains tax rate hikes haven’t correlated to market performance historically

President Joe Biden recently announced his plan to pay for a proposed massive investment in education, infrastructure, and childcare by boosting the tax rate on investment returns, or capital gains, for Americans making more than $1 million per year. His $1.8 trillion American Families Plan would raise the top tax rate on long-term capital gains -- that is, returns on the sale of stocks or other investments -- to 39.6% from its current 20%.

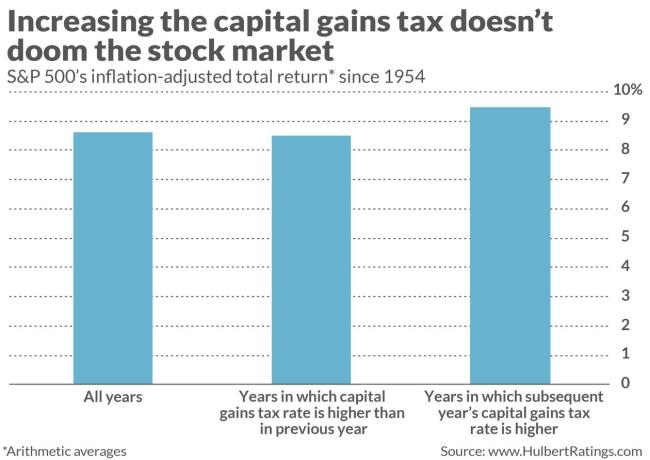

Alongside worries about increasing tax burdens, wealthy Americans may feel concerned about how this policy change could impact stock market performance. Some might fear a stock market sell-off as some investors take advantage of lower tax rates before they climb under new legislation. These worries appear unfounded; although it is impossible to make a prediction about the future*, the fact is historically (and statistically) U.S. stock markets have not been negatively affected by capital gains tax rate hikes in the past. As Mark Hulbert argues, the S&P 500 (as tracked by SPX) has seen a .37 total return since 1954 when the capital-gains tax has been raised. There appears no pattern that is significant at the 95% confidence level that statisticians frequently use when determining if a pattern is genuine (see Image A).

Some of this is explained by two factors:

1. Most stocks in the U.S. are held in accounts that are exempt from the capital-gains tax. Leonard E. Burman, a professor of Public Administration and International Affairs at Syracuse University, reports that the percentage of publicly traded U.S. stocks held in taxable accounts has dropped to under 25% from more than 80% over the past 50 years.

2. Capital gains tax increases don’t change investor behavior substantially in the long run. In the short-term before the hike, some investors may sell to circumvent the increase. However, this could be offset by investors holding positions longer after the tax rate increase is effective. The effect would be canceling and neutral to stock market performance.

Economic factors, like inflation, interest rates, earnings and growth rates have historically influenced the stock market more than capital gains tax increases. To discuss how a potential tax increase could affect your portfolio, contact your Cranbrook Wealth investment professional.

*Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product referred to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Cranbrook Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.